Built by entrepreneurs for entrepreneurs who want to turn hustle into wealth

Designed exclusively for entrepreneurs, R4R helps you turn current profits into long-term wealth through checkbook control, tax-advantaged investing, and innovative automated compliance.

You build business for a living — but have you built your own portfolio?

Entrepreneurs spend years growing companies and creating value for others, yet many never put a long-term plan in place for themselves. Without structure or strategy, income often stays tied to day-to-day operations instead of compounding into lasting wealth.

Tax-heavy income – You keep earning, but taxes continue to take a significant share.

No built-in retirement plan – When you’re self-employed, no one sets this up for you.

Unpredictable cash flow – Cycles of growth and slowdown can make long-term planning feel uncertain.

Asset protection – Properly structured retirement and trust strategies can help shield assets from lawsuits, bankruptcies, garnishments, and other financial risks.

Freedom, to be truly independent

Checkbook-Controlled 401(k)

Take control of your retirement strategy with an investment vehicle built for entrepreneurs and independent business owners. Gain direct access to invest in what you know—such as private businesses, leveraged real estate (without UBIT tax), syndications, and alternative assets. Designed to be tax-advantaged and flexible, with no middlemen, no custodians, and total control over how your capital is deployed.

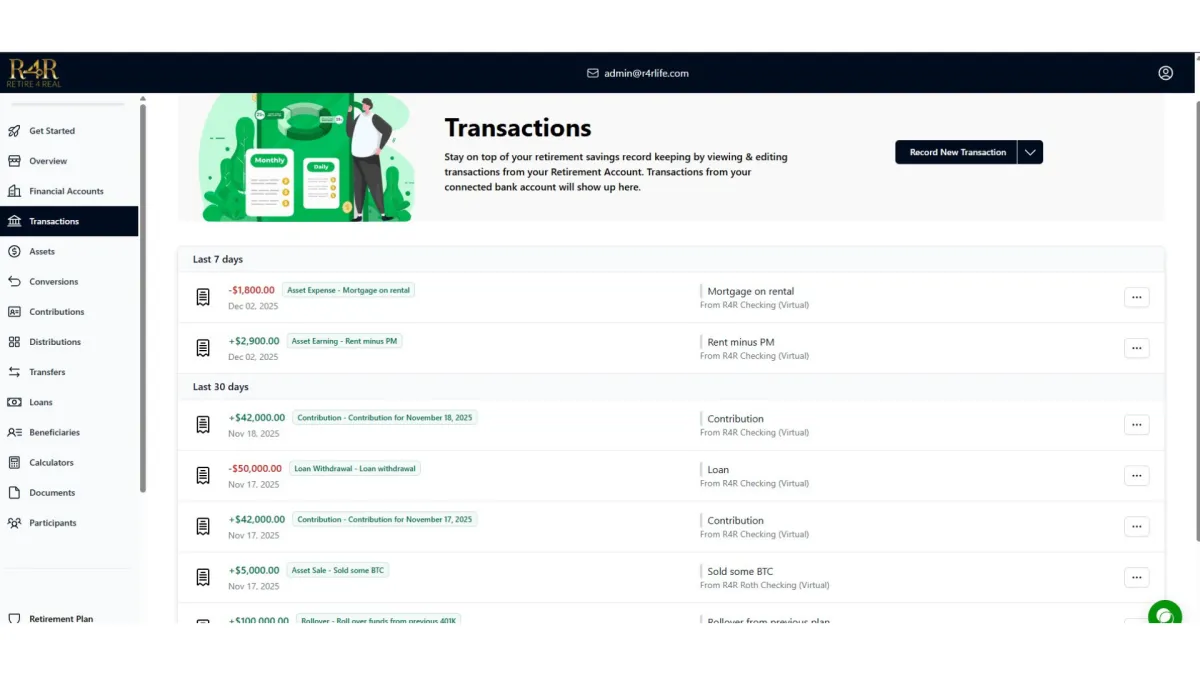

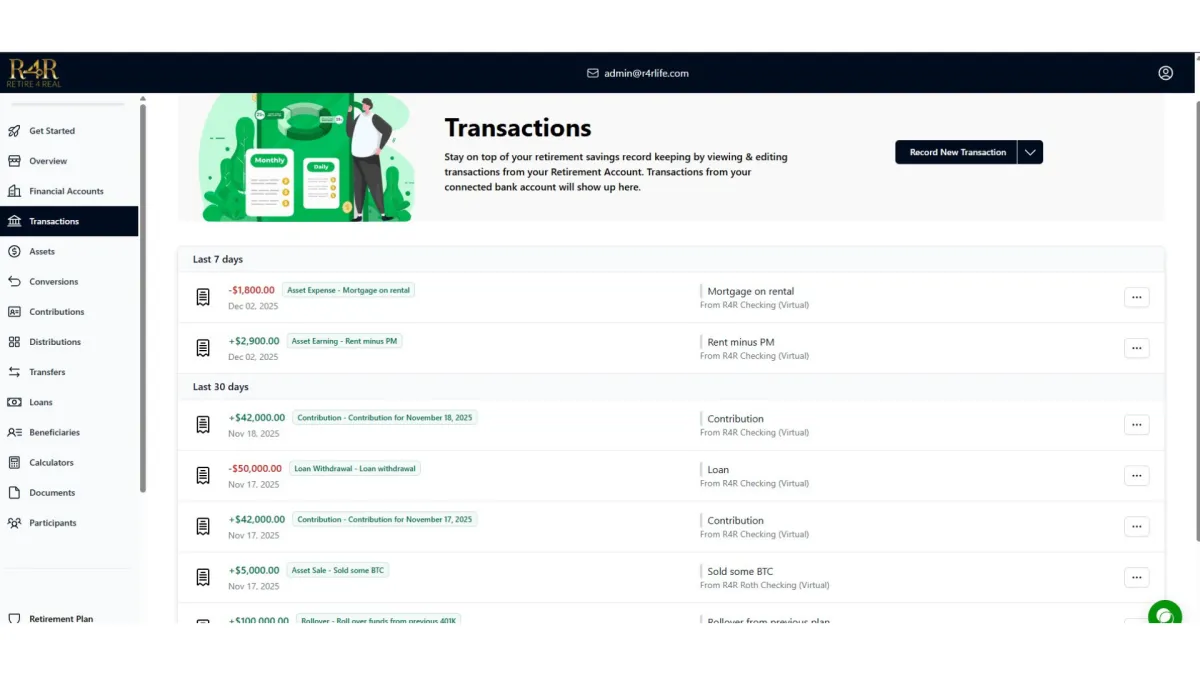

Automated Bookkeeping

Built-in banking integration supports streamlined compliance and visibility. Your R4R Solo 401(k) automatically tracks key activity within your retirement account, including contributions, distributions, assets, and documentation. Everything updates in real time—so you can stay focused on building wealth instead of managing spreadsheets.

Tax-Smart Structures

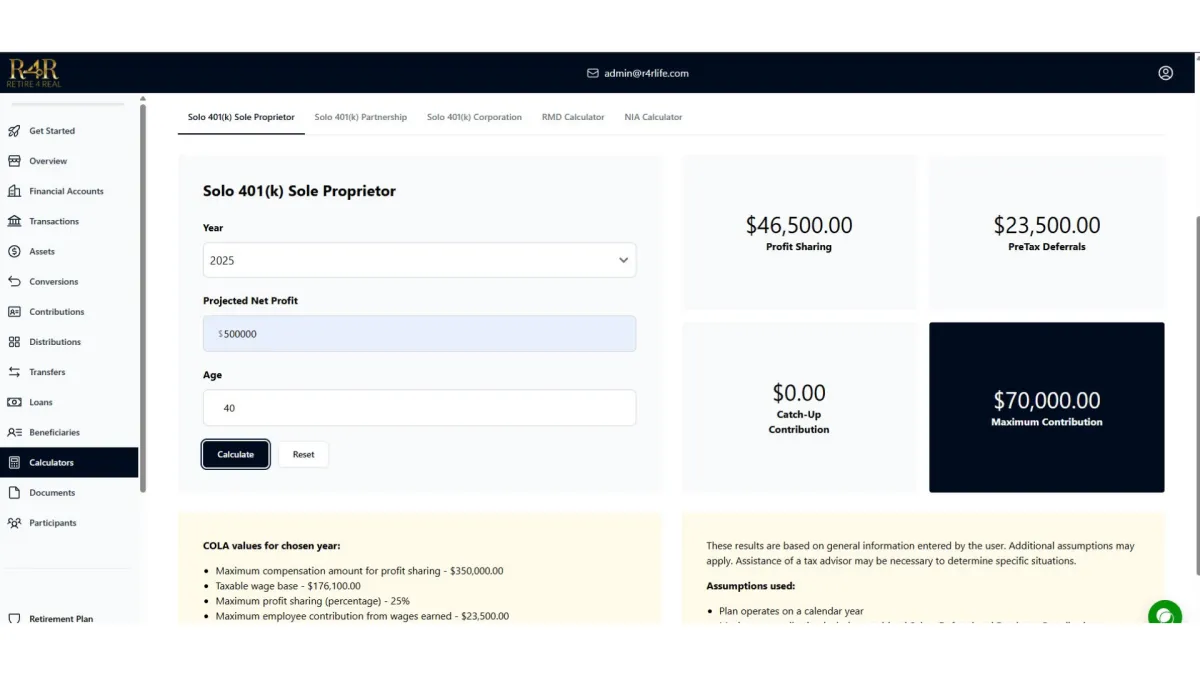

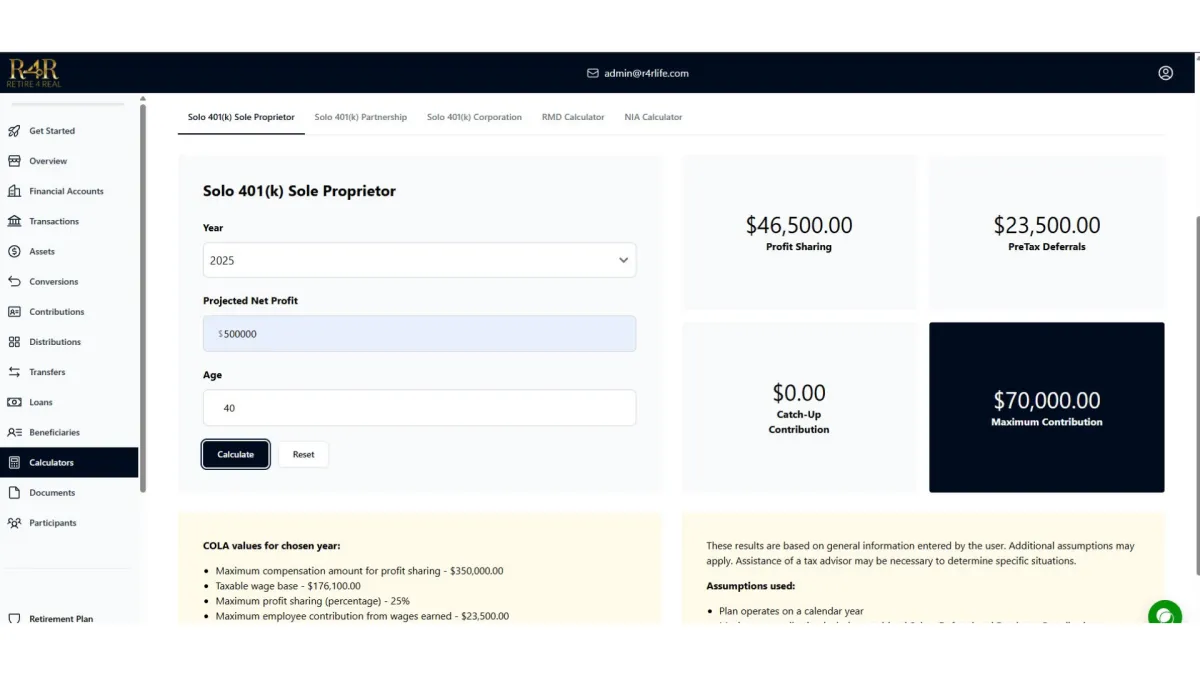

Retirement account structures optimized for business owners looking to retain more income and manage tax exposure. With higher annual contribution limits (over $70k, depending on eligibility) and the ability to utilize Traditional, Roth, and rollover strategies—including advanced Roth conversions (Mega Backdoor Roth)—all within a single, simplified platform.

Be your own bank

Use your retirement plan strategically by lending capital to yourself or your business. With R4R, it is easy to set compliant interest rates and terms that work for you and stay within IRS guidelines. With payments flowing back into your own retirement account, your debt can fund your future. This flexibility can support business growth, real estate investments, major purchases, or liquidity needs—while keeping your money working for you.

Be your own bank

Use your retirement plan strategically by lending capital to yourself or your business. With R4R, it is easy to set compliant interest rates and terms that work for you and stay within IRS guidelines. With payments flowing back into your own retirement account, your debt can fund your future. This flexibility can support business growth, real estate investments, major purchases, or liquidity needs—while keeping your money working for you.

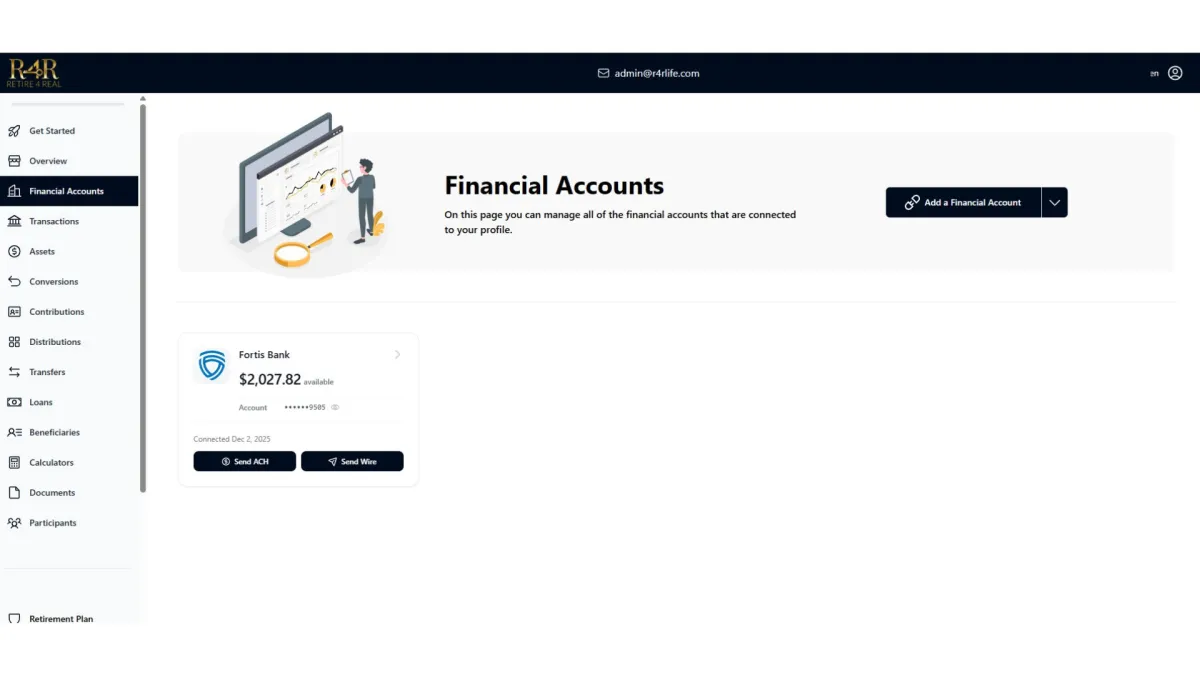

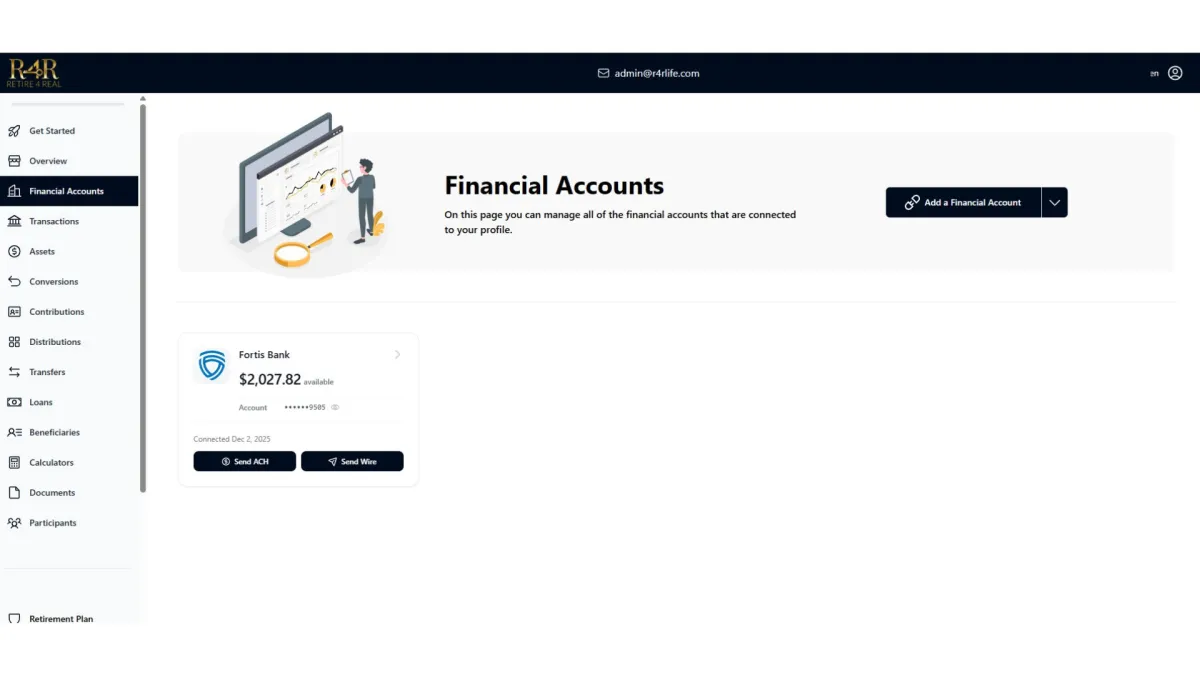

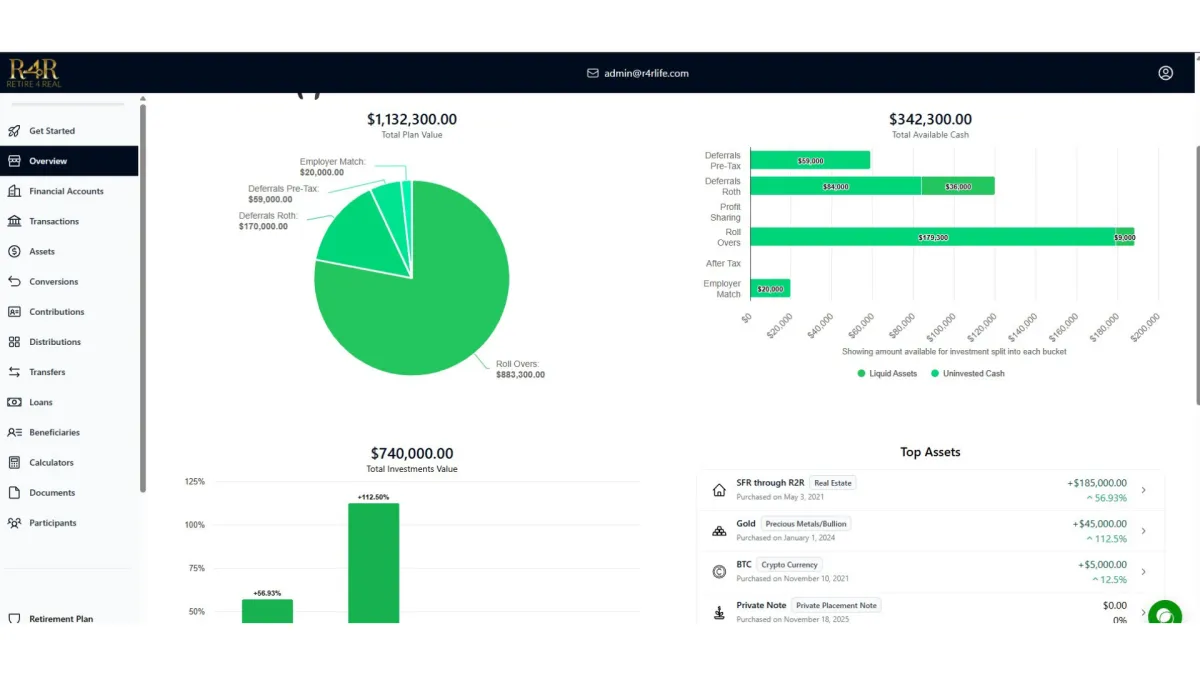

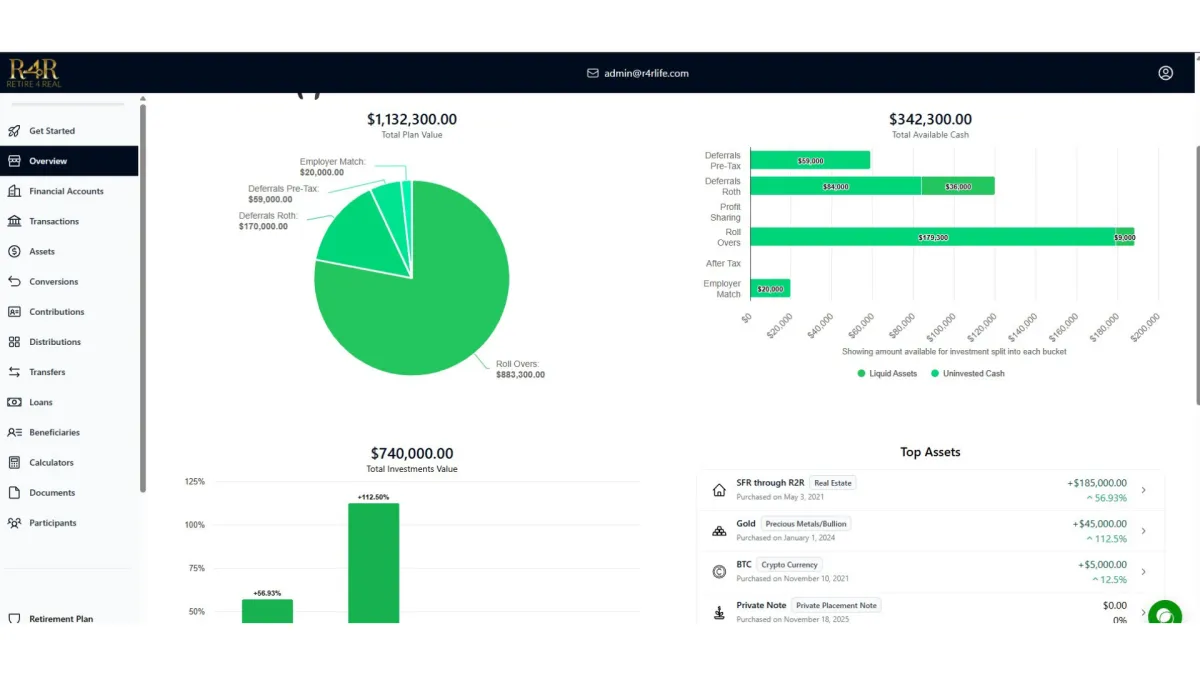

One platform to rule them all

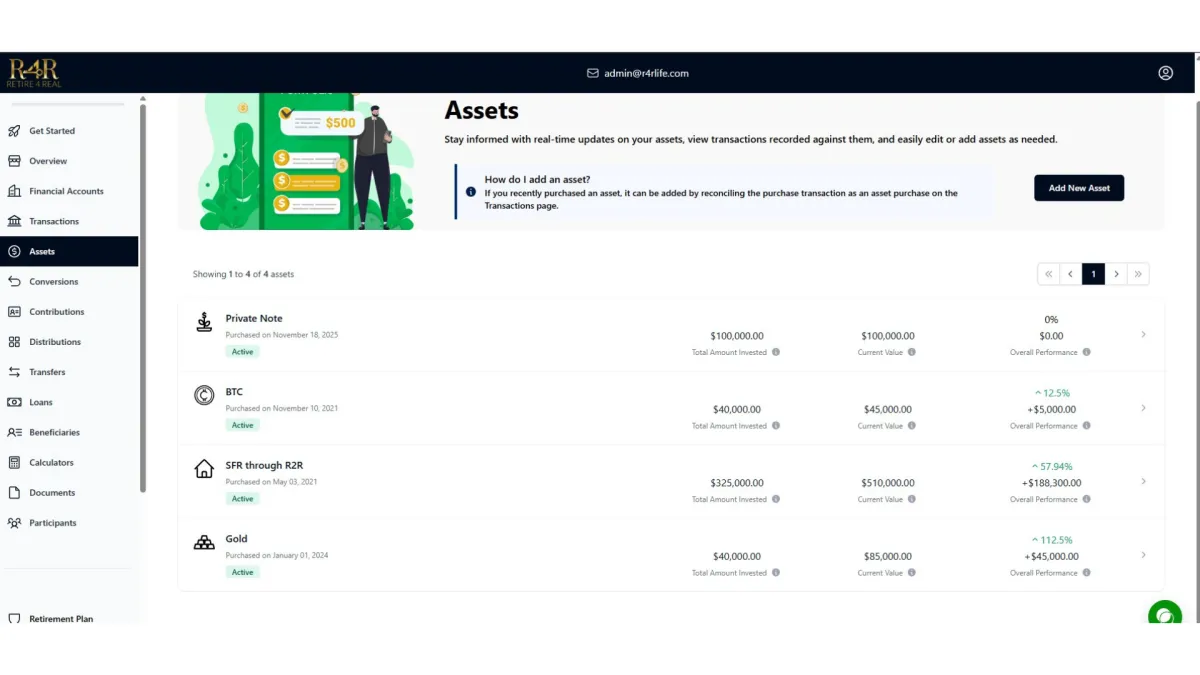

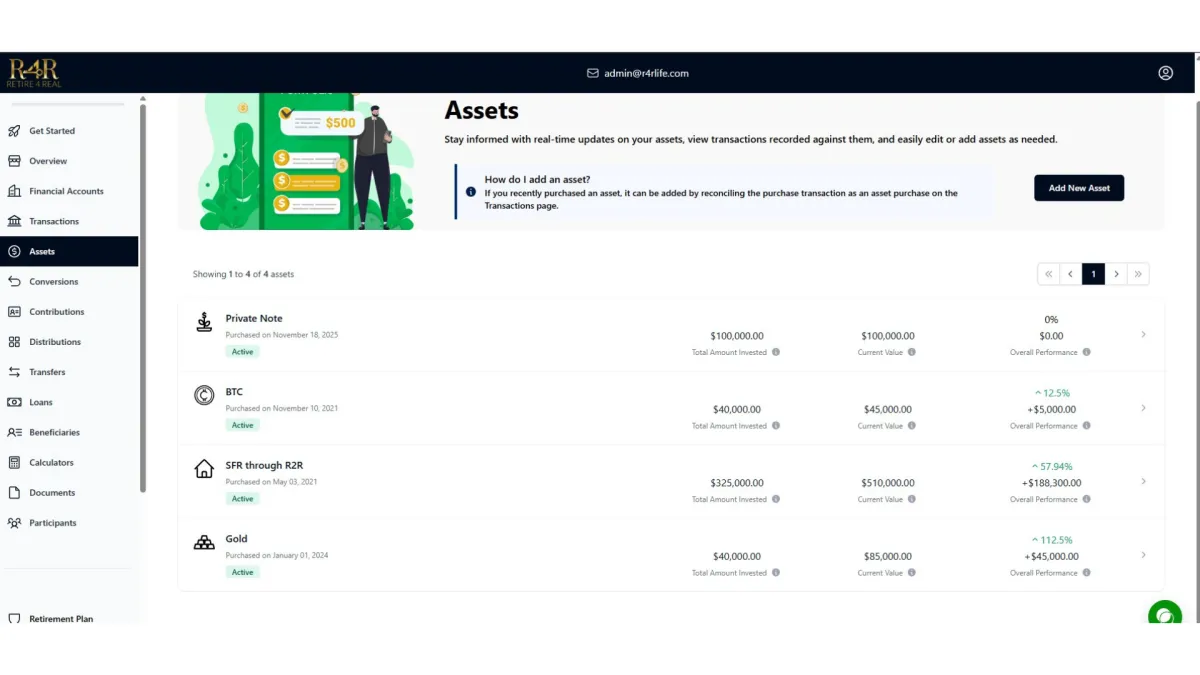

Manage everything in one place. The R4R platform integrates banking, asset tracking, and plan administration, so you can view balances, transfer funds, and monitor activity without leaving the system. Track investments, view current values, monitor income and expenses, and access plan and asset documents, contributions, beneficiaries, distributions, loans, and rollovers—all in one centralized dashboard for you and your advisors.

WHAT YOU GET

Solo R4R

401(k) Setup

Full self-guided setup paired with expert plan creation. Compliant, optimized, and ready for self-directed investing.

Automated

Compliance

A system that tracks every dollar and includes automated, IRS-compliant paperwork—powered by the nation’s leading retirement compliance provider.

Required tax documents are prepared through your R4R platform at no extra cost, saving you an estimated

$500 - $ 2,000 per year.

Unlimited

Possibilities

Invest in individual stocks, indexes, private placements, crypto, precious metals, notes, or even buy your own investment properties. Take control by putting your money in what you understand and believe in.

FAQs

Your Retirement Questions Answered Clearly and Concisely.

Do I need a business first?

A retirement plan can be created as soon as a business is established, allowing you the ability to fund your account with business profits and roll over existing retirement funds into your new plan.

Can I do infinant banking with an R4R 401(k)?

Yes! This is one of our favorite parts of our plans. Pull out a loan in seconds, and pay interest back into your own retirement account: No fees, no tax implications, no worries.

Can I make active income with this?

You understand commissions and so do we. If you bring us a client you will get $500 after they sign up for a full price account!

What does all of this cost?

I love transparent pricing! $2,500 for your first year, including all setup and plan-creation fees, then only $1,500 a year, with your pricing locked in for life! No upsells, no transaction fees, no extra costs, or hidden fees ever! On top of all of that, the entire expense is a business write-off.

Is self directed retirement hard to manage?

This system was made to turn the complexities of running a retirement plan into something simple and easy to utilize to its full potential. You can even share access to your accountant and wealth advisor to use our integrated calculators and tracking systems to help you and your team manage your contributions, rollovers, investments, and distributions.

My spouse works with/for me, can I still open an account?

Yes, our plans are tailored to accept entrepreneurs who earn self-employment income and have no employees other than their spouse. What's even better is that your spouse will have their own 401 (k) plan for no additional cost, giving you double the benefits!